If you’re a Forex trader or planning to enter the world of Forex trading, you might have surely heard about the term ‘Pips.’ Pips in Forex trading detailed Guide for Beginners and seasoned or professional traders are quite familiar with Pips, but it’s quite challenging for beginners to understand what are pips in Forex and how it works? Don’t worry; we’re here to help you out.

The unit of measure every Forex trader uses to determine the smallest change in value between two currencies is called “PIP” (Point in Percentage / Price Interest Point).

In a normal Forex quotation, this is represented as a single-digit move in the fourth decimal position. So, for example, if there’s a movement in the GBP/USD price from 1.3102 to 1.3103, it is said to be one pip or ‘point’ movement.

|

| Pips in Forex trading detailed Guide for Beginners |

However, not all Forex quotes are presented in this manner, with the exception of the Japanese Yen.

After reading this, you might have understood what are pips; now it’s time to move forward to the next topic. So let us start to know Pips in Forex trading.

How Do Pips Work?

The pip is considered a fundamental notion in foreign exchange (Forex trading). Therefore, bid and ask quotes that are accurate to four decimal places are used to distribute exchange quotes in currency pair.

In other words, Forex traders buy and sell a currency to profit from minor price movements.

Pips are a measurement unit for exchange rate movement. The modest change for most currency pairs is one pip, as most currency pairs are quoted to a maximum of the fourth decimal place.

The value of a pip may be estimated by dividing the exchange rate by 1/10,000 or 0.0001. However, pips don’t reflect actual cash value; the pip value is determined by the size of the trade’s position.

By calculating the pip value, traders often determine whether they are making profits or losses from the positions in the Forex market. In addition, it can help them build a good Forex trading strategy.

For instance, Before knowing Pips in Forex trading first let’s understand major currency pairs – if a trader bought GBP/USD, they’d make a profit if the value of pounds increased in relation to the U.S Dollar.

Conversely, if the value of the U.S Dollar increases in relation to the pound, they’ll suffer loss. So, the right Forex trading strategy is necessary for every aspect.

What is a Pip Value Calculator and How Does It Work?

The pip value is determined by three major factors- the Forex pair being traded, the trade volume, and the exchange rate.

Because of these considerations, even a single pip value change may have a big influence on the value of open trade.

To calculate pip value – One pip (0.0001) is multiplied by the relevant lot/contract size. This involves 100,000 basic currency units for normal lots and 10,000 units for micro-lots.

The calculation of one pip value assists Forex traders in putting a monetary value on their take profit and stop loss goals.

Traders can speculate how the value of their trade will vary when the Forex markets move rather than just looking at pips.

It’s vital to remember that the value of one pip varies depending on the currency pairs. This is due to the fact that the value of one pip will always be displayed in the quote/variable currency, which will vary while trading multiple currency pairings.

The step-by-step calculation formula for pip value

Here’s how to calculate Pips?

First and foremost, choose a pip size. All currency pairs have a value of 0.0001 except for a few, such as the Japanese yen, which has a value of 0.01 due to the yen’s low value.

Calculate the current rate of exchange.

Use the following general formula to compute the pip value for a certain position size:

Pip value = (pip size/exchange rate) x position size

Now, convert the pip value to your base currency using the current exchange rate.

What are Pipettes in Forex Trading?

Pipettes are pips that are fractional in size and often known as Fractional pips. It’s one-tenth of a pip, commonly calculated with the fifth decimal point (in JPY pairs, it is calculated using the 3rd decimal).

Because a fractional pip equals 1/10 of a pip, the GBP/USD currency pair can be viewed with pipettes to five decimal places.

Meanwhile, Foreign currency pairs with the Japanese yen as the quote currency can be viewed to three decimal places. In the quote panel, pipettes are displayed in superscript format.

What is the Difference between Pipes and Pipettes?

The smallest fraction of a currency pair’s price movement is called a pip. Many Forex trading platforms use pips as the lowest fraction that currencies may move, but the desire for more precision has invented pipettes, which are fractions of a pip.

A pipette is 1/100,000th of a pip (one in a hundred thousand). If the GBP/USD pair is at 1.31548 and two pipettes advance, the pair will be at 1.31550. The platform’s fifth decimal digit represents pipettes.

Depending on the size of the position (lot) that a trader/investor has opened, the value of a pip/pipette in dollars or euros will be variable.

Conclusion on Pips in Forex trading detailed Guide for Beginners

As we have discussed What are pips in Forex trading for beginners. Through this article, hope you’ve understood how to calculate the pip value in a currency pair.

Understanding the value of a pip and all the basics can help you become a successful Forex trader.

Traders can determine the right position size with the help of pips. In addition, it also ensures them that they are not taking riskier and long positions.

This article about Pips in Forex trading is specially written for beginners who want to start their Forex trading journey with a bang. Hopefully, you have got what you were searching for.

Now is the time for some practical work, meaning putting all your theoretical knowledge into real trading.

To get started, the first thing you’ll have to do is open a brokerage account with a good and reliable Forex broker such as PrimeFin. After that, you can start with a demo account if you’re still unsure about entering the Forex markets.

Our recommendation for choosing this broker is based on various factors such as the past performance, range of currency pairs available, and good services of this trading platform.

That’s all for this topic! If you’re still looking to strengthen your Forex trading knowledge, then read our Free Trading Guides. This comprehensive guide will probably teach you all you need to know about currency trading.

I hope you can also find this article can cryptocurrency replace traditional currency? helpful.

I tried to put my view in simple words.

Do share this article. See you in the next one.

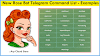

Some more useful articles like we can create telegram bot using bot father telegram bot used to create our own bots.

That's it in this article.